salt tax cap expiration

As adopted under the Tax Cuts and Jobs Act the cap is set to expire at the end of 2025. The SALT cap significantly impacts individuals living in.

Congress And The Salt Deduction The Cpa Journal

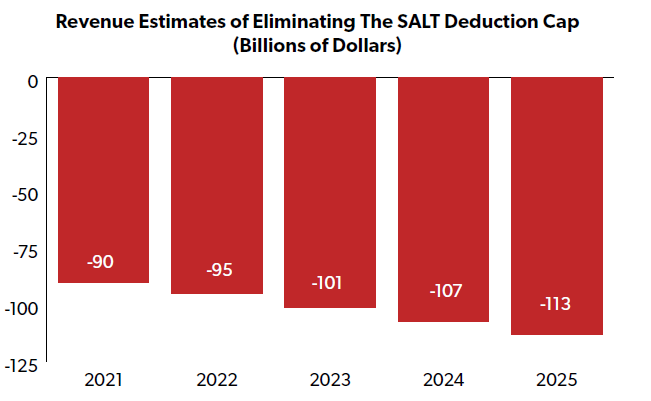

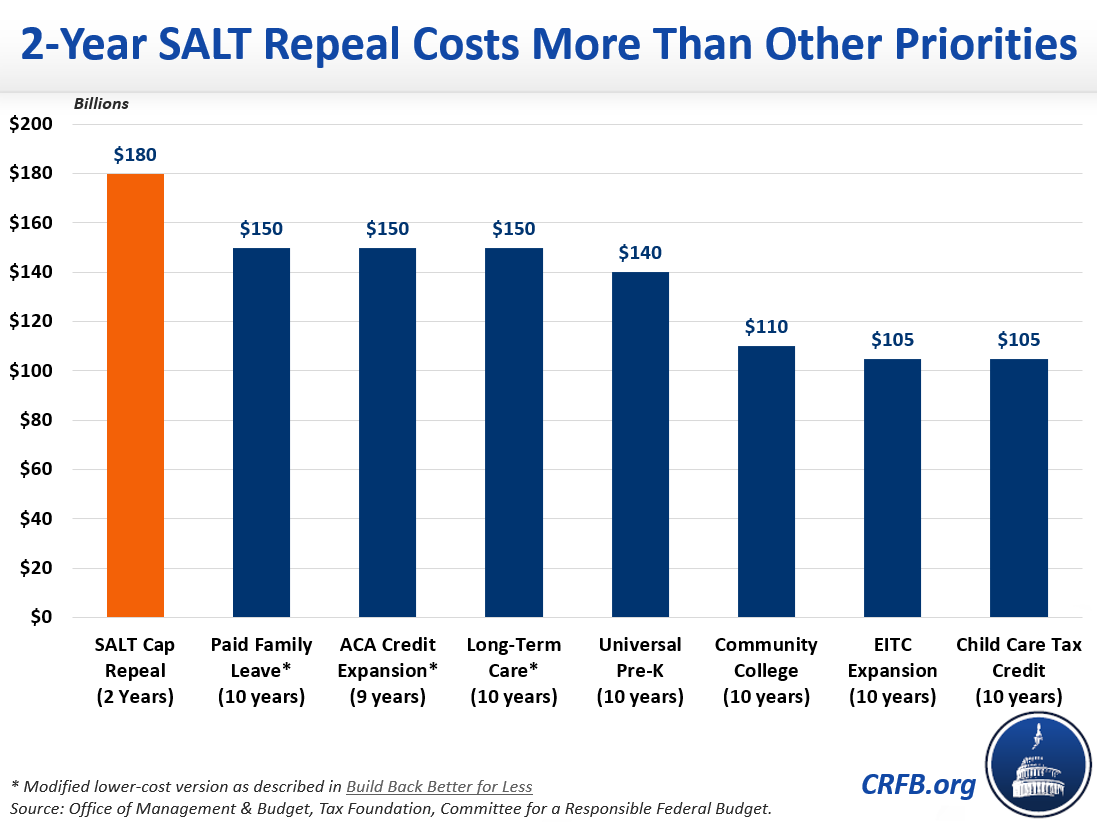

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

. Since the 10000 cap is scheduled to expire at the end of 2025 keeping the cap in place for those later years would raise significant revenue relative to current law. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. The SALT deduction however will continue to be important for those who itemizewhich is to say for wealthier taxpayersIf Congress does not make permanent the.

This cap remains unchanged for your 2021 taxes and it will remain the same in. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to. Without changes the current 10000 cap will expire after 2025.

That figure dropped to 21 billion in 2020. The existing 10000 limit on SALT is scheduled to expire at the. The Ways and Means bill would raise the cap in 2019 to 20000 for married couples and repeal it altogether in 2020 and 2021.

The SALT cap has been debated by federal policy makers since its adoption. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit to determine the portion of any state or local tax refund that must be included on the taxpayers. The cap applies to taxable years 2018 through 2025.

However nearly 20 states now. While the Tax Cuts and Jobs Act placed a 10000 cap on the SALT deduction its only temporary. Taxpayers who itemize may deduct up to 10000 of property sales or income taxes already paid to state and local governments.

As with many other elements of the 2017 tax law the SALT cap is temporary. Nov 2 2021. Currently the SALT cap is 10000 and is scheduled to expire for tax years beginning on or after Jan.

It applies only to tax returns filed for 2018 through 2025. Democrats have Republicans to thank for clearing the way for the budgeting tricks that will allow them to do that. The bill would boost the limit to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031.

Under current law a taxpayer may deduct up to 10000 of any state and local taxes paid. Fortunately this limitation is only temporary. Ronn Blitzer is a.

The current SALT cap is scheduled to expire after 2025 which would allow for an. Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000. The current SALT cap is set to expire after 2025.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. The 2017 Tax Cuts and Jobs Act temporarily capped the deduction for aggregate state and local taxes including income and property taxes or sales taxes in lieu of income. Fox News Shannon Bream and Bill Mears and Fox Businesss Megan Henney contributed to this report.

The bill would offset the cost by reversing. Before the TCJA there was no cap to the value of the SALT. As alternatives to a.

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

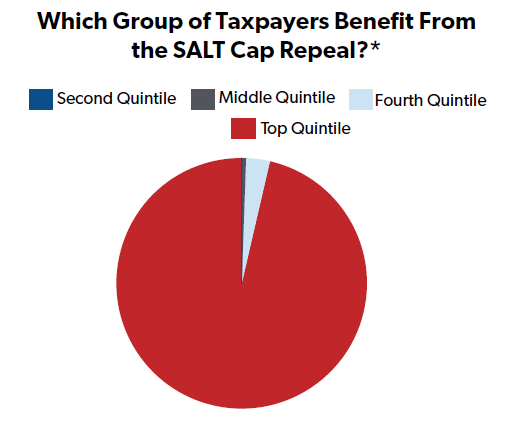

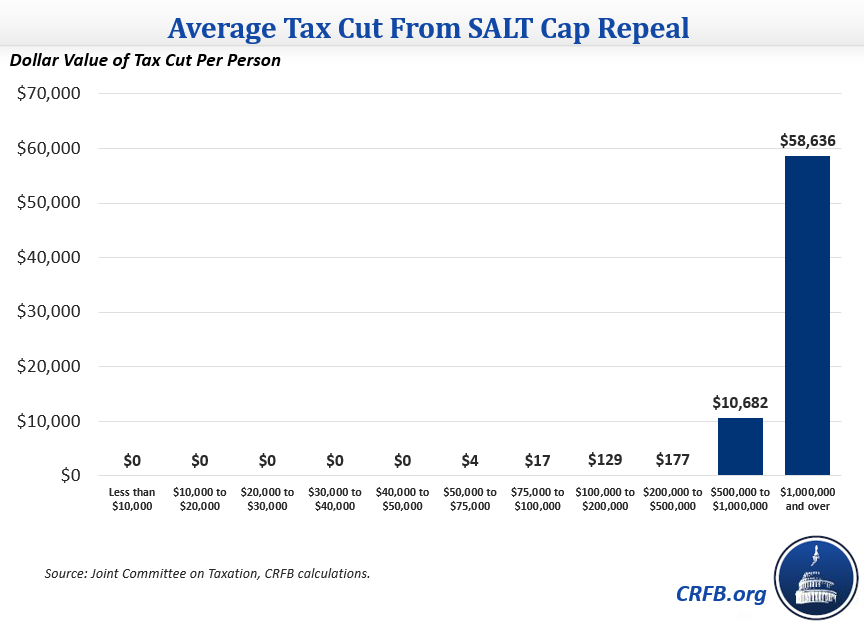

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Salt Tax Joe Manchin Says No As Nj Delegation Scrambles

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salve For The Salt Tax Wound Wealth Management

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Senate Should Improve Salt Provision In House Bbb Bill Center On Budget And Policy Priorities

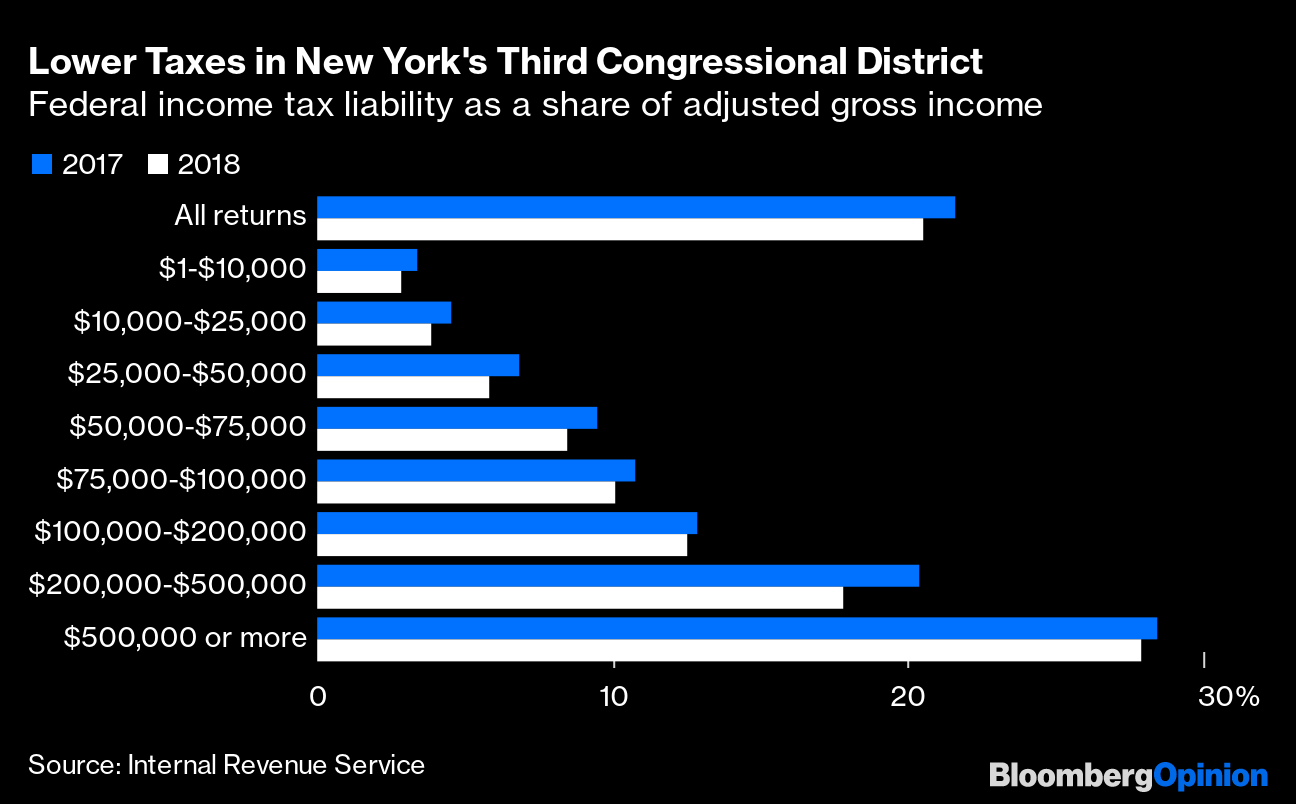

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

Minnesota Salt Cap Workaround Salt Deduction Repeal

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Opinion 14 U S States Now Give The Rich This Big Tax Break And The Only Loser Is Uncle Sam Marketwatch

Congress And The Salt Deduction The Cpa Journal

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Is Salt Kosher Democrats Favorite Tax Cut For The Rich Arcadia Political Review